Exemplary Info About How To Buy Tax Sale Properties

Contact your county tax office, or the county of the property you wish to purchase, for dates and times of the next tax sale.

How to buy tax sale properties. Arrive at the public auction venue. The government can put a lien on your home, car, or any other property you own. Properties being sold to the highest bidders for a fractio.

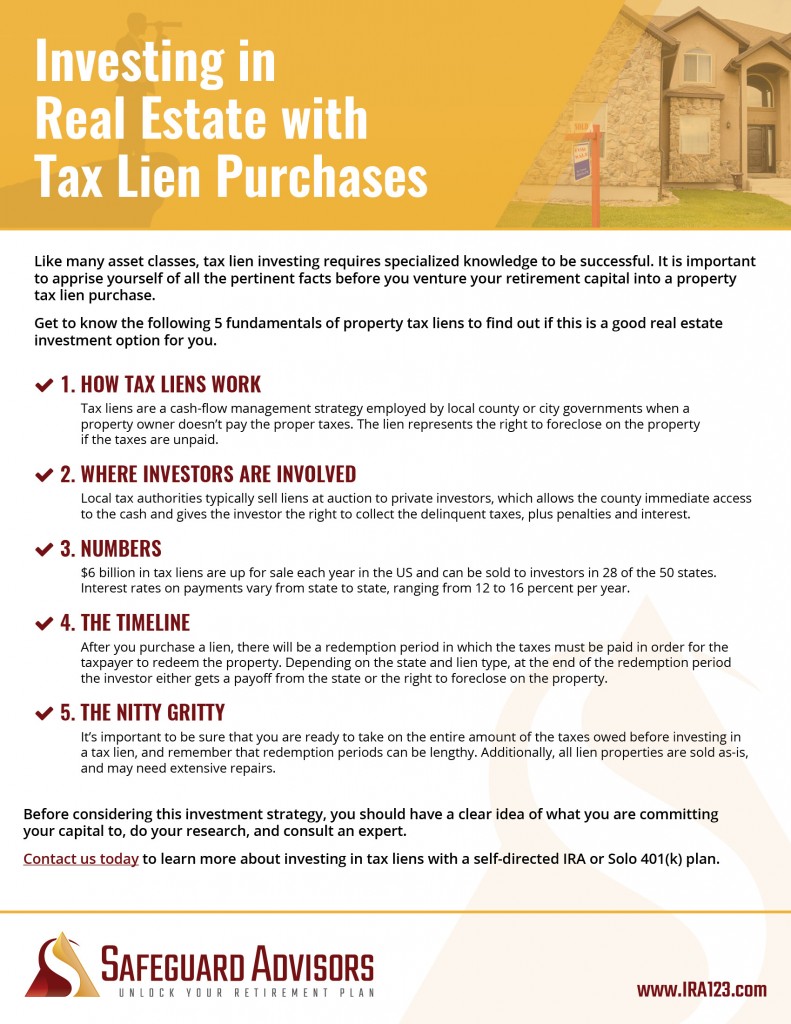

There are two ways to profit from tax lien investing: The tax sale is used to collect delinquent real property taxes and other unpaid charges owed to the city, all of which are liens. You may search for transcripts of properties currently available by county, cs number, parcel number, or by the person’s name in which the property was assessed when it sold to the state.

The first rule of how to buy tax defaulted properties is know what you’re buying. These tax sales are held at scheduled times. If you plan to bid on a house at a tax lien sale, you’ll need a cashier’s check.

Through interest payments or taking ownership of the property. Learn about tax liens and real estate auctions: The exact process for a tax lien or deed sale varies by state, but you'll find some common aspects.

The local government conducting the sale must post public notice in. Anyone can attend a tax sale and bid on tax certificates, the tax interest in the subject properties. Just remember, each state has its own bidding process.

The time and venue where the auction will be held is. To buy a tax sale property, you will need to attend the public auction in person. Here is a new step in the transaction that comes after the agreement to sell property is finalised.

/GettyImages-1137448188-45959ad13a7f4625b3969fe1fb9295af.jpg)