Top Notch Info About How To Spot A Bubble

See, the thing that defines a bubble isn’t that valuations are extremely high, or that expected returns are extremely low.

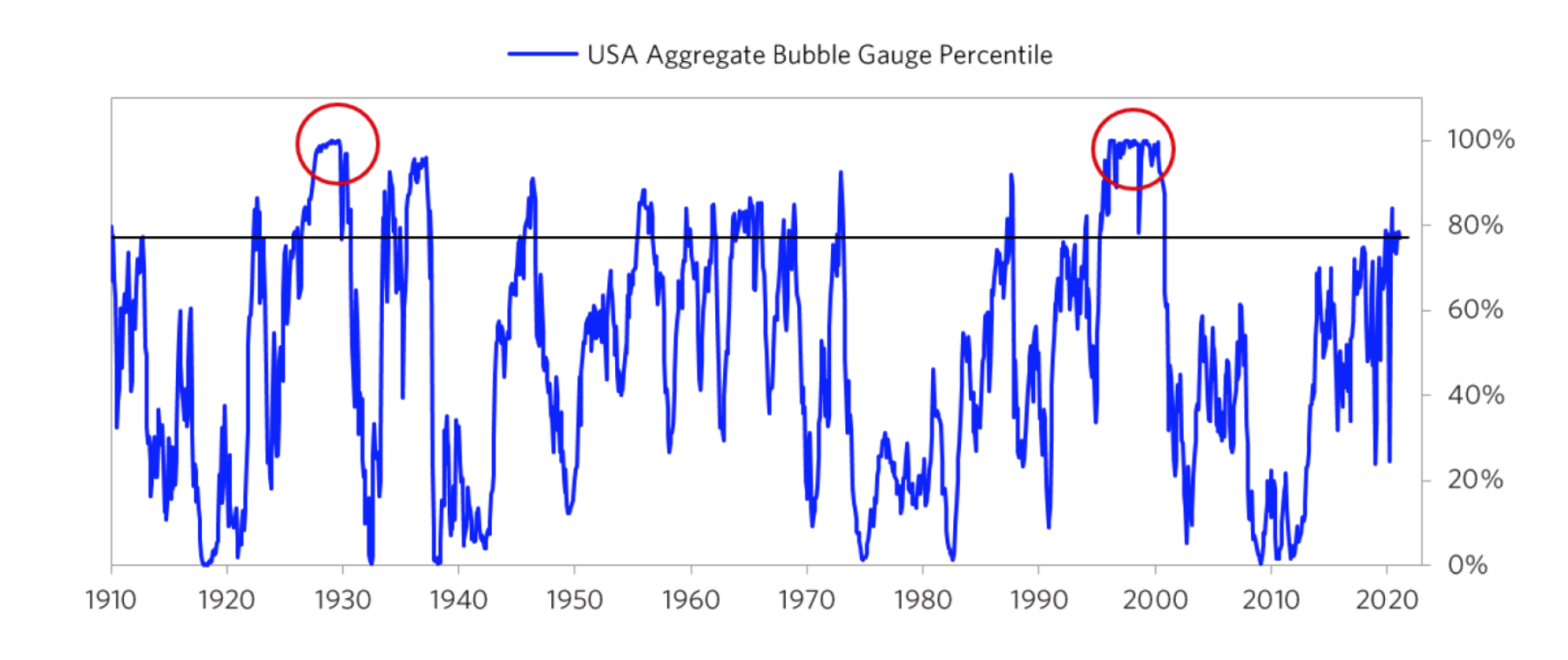

How to spot a bubble. In the “bubble” case, investors have high expectations about future returns, mainly based on past returns, and they act on those. Recognize that future returns will be lower. The term bubble, in an economic context, generally refers to a situation where the price for something—an individual stock, a financial asset, or even an entire.

It sent a ripple through the commodity system, which you see most visibly in plunging commodity. Its hard to identify a bubble when you are in the midst of one, and looking back on the market dynamics of the past few years the only surprise has been that we didn·t see the air. Interest rates since low rates tend to fuel bubbles.

There are a few key reasons why an increase in demand for housing is often seen as a clear indicator of a housing bubble. Bubbles occur when assets become artificially expensive, driven by misconception Instead, what defines a bubble is that investors drive valuations.

That is, investors extrapolate past. Here’s what to watch for. When assets are traded at a price that strongly exceeds their real value, look for an economic bubble to burst.

The first is the slowdown in china. That investment bubble has burst. Instead, what defines a bubble is that investors drive valuations higher without simultaneously adjusting expectations for returns lower.

You can often see this with the stock chart rising in a near parabolic fashion. The second type of a.

/5stagesofabubble-3414b3441b79413cb34c6a49c1167903.jpg)